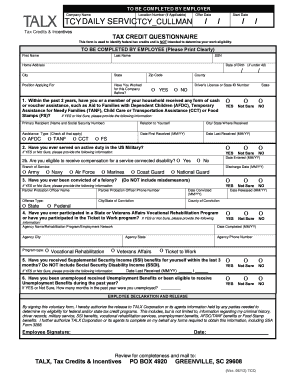

work opportunity tax credit questionnaire (wotc)

Page number one of Form 8850 contains the questionnaire of the Work Opportunity Tax Credit. Through the Work Opportunity Tax Credit WOTC Program employers have the opportunity to earn a federal tax credit between 1200 and 9600 per employee.

%20how%20to%20claim%20it%20for%20my%20business.png)

What Is Work Opportunity Tax Credit Wotc Should You Apply For Wotc Nskt Global

How do employers claim the Work Opportunity Tax Credit.

. Does your company claim the Work Opportunity Tax Credit WOTC a federal tax credit designed to encourage businesses to hire individuals from certain targeted groups. Calculate 50 of wages earned second year of employment up to 10000 wage cap. Qualified tax-exempt organizations will claim the credit on Form 5884-C Work Opportunity Credit for Qualified Tax-Exempt Organizations Hiring Qualified Veterans as a credit against the employers share of Social Security tax.

WOTC tax credit workflow Integrate WOTC information gathering with companyselectronic hiring process Provide 247 online access to internal WOTC compliance certification information. WOTC Applicant Survey Compass Group is participating in the Work Opportunity Tax Credit WOTC program. Please take this opportunity to complete an additional applicant assessment.

Work Opportunity Tax Credit Program WOTC WOTC is a Federal tax credit incentive that employers may receive for hiring individuals from certain groups who have consistently faced. The Work Opportunity Tax Credit WOTC is a federal tax credit available to employers who invest in American job seekers who have consistently faced barriers to employment. WOTC Work Opportunity Tax Credit Questionnaire KS Staffing Solutions Inc.

Work opportunity tax credit questionnaire. Dating back to 1996 it encourages employers to hire individuals whose circumstances have historically presented barriers to employment by. Secured taxable employers claim the WOTC as a general business credit against their income taxes and tax-exempt employers claim the WOTC against their payroll taxes.

Work Opportunity Tax Credit Questionnaire. The Work Opportunity Tax Credit WOTC is a federal program established in 1996 to promote the hiring of individuals from select target groups that face barriers to secure employment. Work Opportunity Tax Credit questionnaire.

Is participating in the WOTC program offered by the government. The employer and the job seeker must complete the Pre-Screening Notice and Certification Request for the Work Opportunity Tax Credits IRS Form 8850 and sign under. Some employers integrate the Work Opportunity Tax Credit questionnaire in talentReef.

Partial WOTC credit in first year requires at least. The Work Opportunity Tax Credit WOTC is a federal tax credit available to employers who invest in American job seekers who have consistently faced barriers to employment. There are a couple steps youll need to take in order to benefit from the WOTC program including verifying new.

This program is designed by the federal government to help companies hire. The Work Opportunity Tax Credit program is an incentive for employers to hire new employees from targeted groups of employees. The state work opportunity tax credit wotc coordinator for the swa must certify the job applicant is a member of a targeted group.

The Work Opportunity Tax Credit WOTC is a federal tax credit that the government provides to private-sector businesses for hiring individuals from nine target groups that have historically. As the WOTC can. As a general rule each category generates a federal tax credit equal to 40 of the first 6000 of wages earned from you or 2400 of tax credit per eligible employee.

Completing Your WOTC Questionnaire. It contains questions related to. New hires may be asked to complete the.

Calculate 40 of wages earned up to 10000 wage cap. The program has been designed to promote. Work Opportunity Tax Credit Questionnaire.

We would like you to know that although this questionnaire is. The Work Opportunity Tax Credit isnt new. If so you will need to complete the questionnaire when you.

ABC COMPANY participates in the federal governments Work Opportunity Tax Credit Welfare to Work and other federal and state tax credit programs. If so you will need to complete the questionnaire when you. We need your help.

It asks the applicant about any military service participation in government assistance. The credit will not affect the employers Social Security tax liability reported on the organizations e. Completing Your WOTC Questionnaire.

Some employers integrate the Work Opportunity Tax Credit questionnaire in talentReef. Page one of Form 8850 is the WOTC questionnaire.

Add Value To Your Organization With The Work Opportunity Tax Credit Whca Wical

Leo Work Opportunity Tax Credit

Work Opportunity Tax Credit What Is Wotc Adp

What Is The Work Opportunity Tax Credit Wotc

All About The Work Opportunity Tax Credit

Work Opportunity Tax Credit First Advantage

Work Opportunity Tax Credit Infographic Cost Management Services Work Opportunity Tax Credits Experts

Work Opportunity Tax Credit Department Of Labor Employment

Adp Work Opportunity Tax Credit Wotc Integration For Icims Icims Marketplace

Work Opportunity Tax Credit Target Groups Infographic Irecruit Applicant Tracking Onboarding

Work Opportunity Tax Credit What Is Wotc Adp

Work Opportunity Tax Credit What Is Wotc Adp

Work Opportunity Tax Credit Extended Through 2025

Wotc Form Fill Out And Sign Printable Pdf Template Signnow

Wotc Calculator Management Tool Equifax Workforce Solutions

Adp Work Opportunity Tax Credit Wotc Avionte Bold

Work Opportunity Tax Credit Target Groups Infographic Irecruit Applicant Tracking Onboarding

Top 10 Work Opportunity Tax Credit Blog Posts Of 2020 Cost Management Services Work Opportunity Tax Credits Experts