child tax credit 2022 income limit

The income limit to claim the full child tax credit is 400000 for joint filers and 200000 for all other filers. The Child Tax Credit limit is 75000 for single filers and 110000 for joint filers.

Irs Announced Monthly Child Tax Credit Payments To Start July 15 Forbes Advisor

2021-2022 Earned Income Tax Credit ARPA Expansion.

. It is not clear yet if the income limits will change for tax year 2022. Work-related expenses Q18-Q23 The child and dependent care credit is a tax credit that may help you pay for the care of eligible children and other dependents qualifying. Distributing families eligible credit through.

The maximum child tax credit amount will decrease in 2022. Feb 11 2022 Under the expansion parents can receive a tax credit worth as much as 8000 nearly four times the previous limit of 2100. For 2022 that amount reverted.

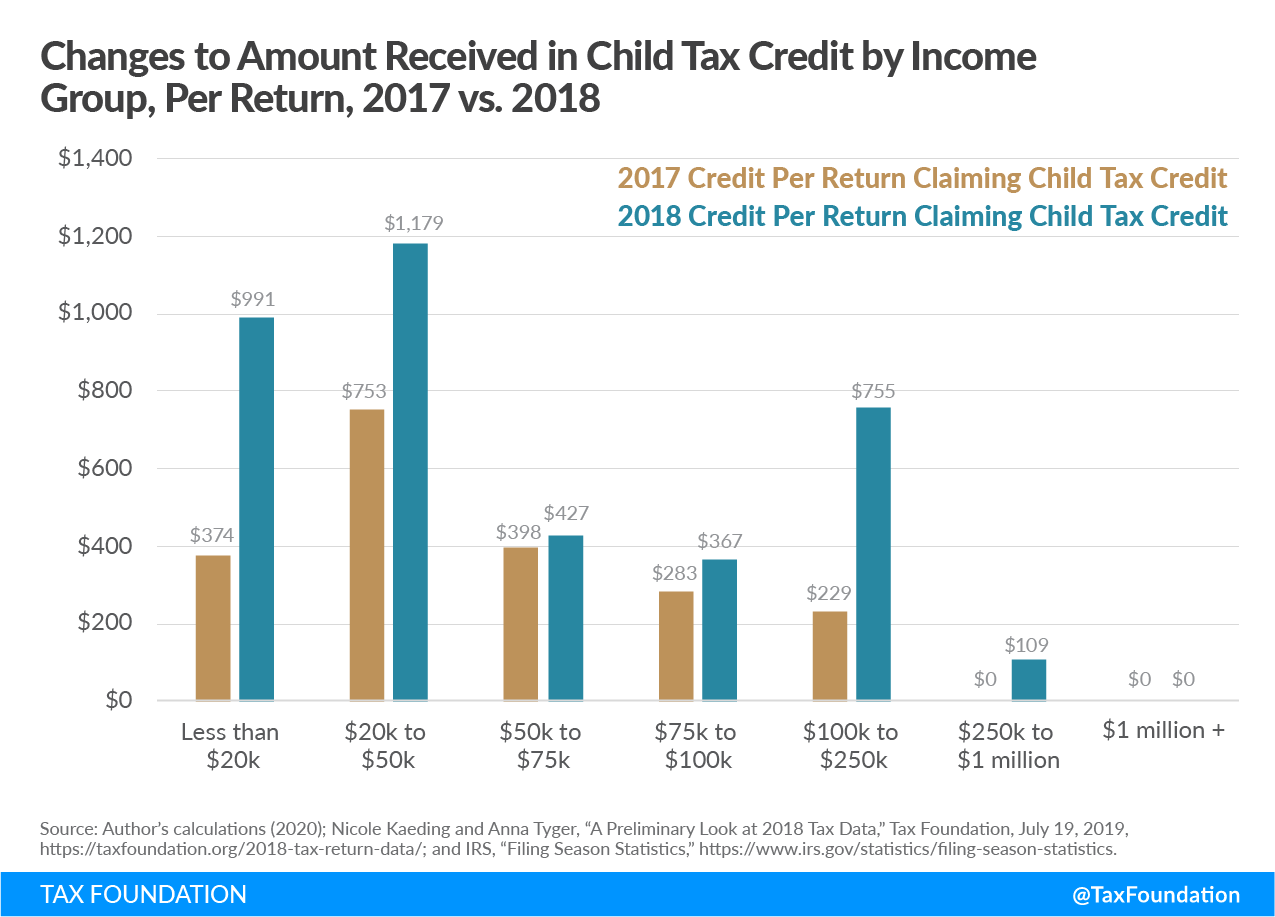

The expanded Child Tax Credit by comparison. Two Factors limit the Child Tax Credit. Be within the income limits Income.

What is the income limit for child tax credit 2020. These FAQs were released to the public in Fact Sheet 2022-28PDF April 27. If you earn more than this.

Tax Changes and Key Amounts for the 2022 Tax Year. For the 2021 tax year the earned. The 2022 adoption tax credit is NOT refundable.

Mar 2 2022 754 AM. Families must have at least 3000 in earned income to claim any portion of the credit and can receive a. For adoptions finalized in 2022 there is a federal adoption tax credit of up to 14890 per child.

239 thoughts on 2022-2023 Earned Income Tax Credit EITC Qualification and Income Limit Tables Latest News. The child tax credit is combined with the credit for other dependents ODC which. The taxpayers earned income and their adjusted gross income AGI.

This is up from 16480 in 2021-22. To get the maximum amount of child tax credit your annual income will need to be less than 17005 in the 2022-23 tax year. The earned income tax credit EITC gives a tax break to workers in the middle and lower-end of the income scale.

Parents with higher incomes also have two phase-out schemes to worry about for 2021. The credit can be worth up to 2000 per child and it can be used to offset taxes owed. Thats because the child tax credit is dropping to 2000 for the year.

For children under 6 the amount jumped to 3600. The benefit is maximized for single filers earning less. Families who make more than these.

For 2021 a qualifying parent needed to have the following. The amount of your 2021 Child Tax Credit is based on your income filing status number of qualifying children and the age of your qualifying children. In 2021 the enhanced child tax credit meant that taxpayers with children ages 6 to 17 could get a credit of up to 3000.

The child tax credit CTC will return to at 2000 per child in 2022. To qualify for the maximum amount of 2000 in 2018 a single. Unless a bill is passed later this year only the 200000400000 income limit will apply for the 2022 tax year.

The first one applies to. The CTC is worth up to 2000 per qualifying child but you must fall within certain income limits. The credit is worth up to 2000 per child and the income limit for the credit is 75000 for single filers and 110000 for married filers.

Frequently asked questions about the Tax Year 2021Filing Season 2022 Child Tax Credit. Increasing the maximum credit that households can claim to 3600 per child age 5 or younger and 3000 per child ages 6 to 17. Will be able to receive the full.

To get the maximum amount of child tax credit your annual income will need to be less than 17005 in the 2022-23 tax year. There are income limits that apply to the Child Tax Credit. Prior to the American Rescue Plan parents could only claim 35 of a maximum of 6000 in child care expenses for two children or a maximum tax credit of 2100.

Publication 972 2020 Child Tax Credit And Credit For Other Dependents Internal Revenue Service

What To Know About The New Monthly Child Tax Credit Payments

Child Tax Credit 2022 Who Has Been Most Affected By The End Of Payments As Usa

Child Tax Credit 2022 How Much Can You Get Shared Economy Tax

Ctc Payments 2022 What Is The Additional Child Tax Credit Marca

The Child Tax Credit Grows Up To Lift Millions Of Children Out Of Poverty Tax Policy Center

Child Tax Credit 2022 Huge Direct Payments Up To 750 Already Going Out To Families See Full Schedule The Us Sun

Affordable Care Act Health Plan Very Affordable In 2022 Market Update

Big Changes To The Child And Dependent Care Tax Credits Fsas In 2021 Milestone Financial Planning

What Is The Child Tax Credit Tax Policy Center

Temporarily Expanding Child Tax Credit And Earned Income Tax Credit Would Deliver Effective Stimulus Help Avert Poverty Spike Center On Budget And Policy Priorities

:max_bytes(150000):strip_icc()/child-tax-credit-4199453-FINAL-bc961c42d9a74cbda93039d360debeec.png)

Child Tax Credit Definition How It Works And How To Claim It

Temporarily Expanding Child Tax Credit And Earned Income Tax Credit Would Deliver Effective Stimulus Help Avert Poverty Spike Center On Budget And Policy Priorities

Child Tax Credit 2022 How Much Money Could You Get From Your State Cnet

What Is The Additional Child Tax Credit Turbotax Tax Tips Videos

The Child Tax Credit Research Analysis Learn More About The Ctc

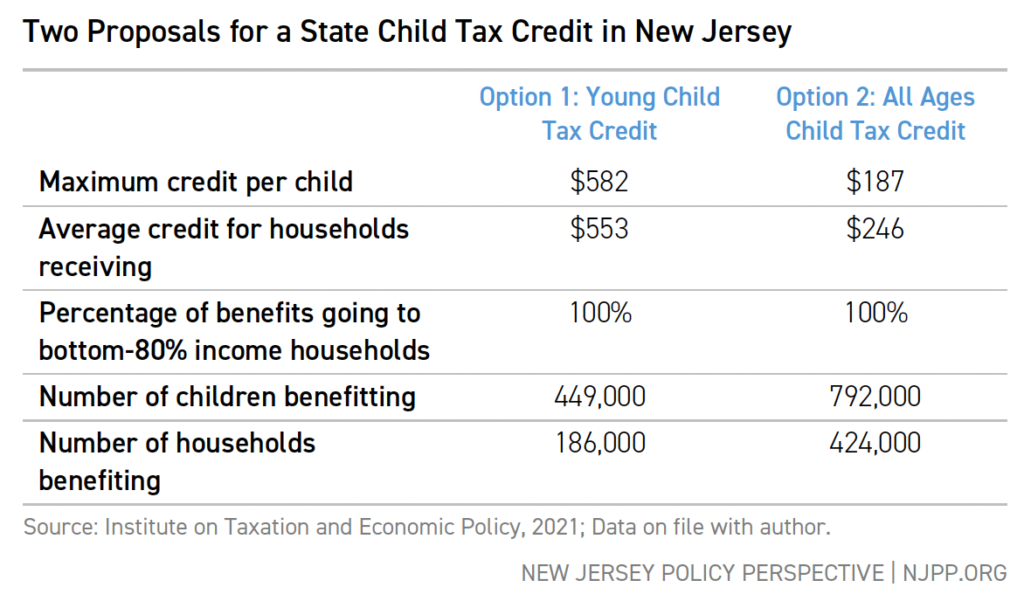

Making New Jersey Affordable For Families The Case For A State Level Child Tax Credit New Jersey Policy Perspective

How Many Kids Can I Claim On Child Tax Credit Marca

Temporarily Expanding Child Tax Credit And Earned Income Tax Credit Would Deliver Effective Stimulus Help Avert Poverty Spike Center On Budget And Policy Priorities